accrual vs cash

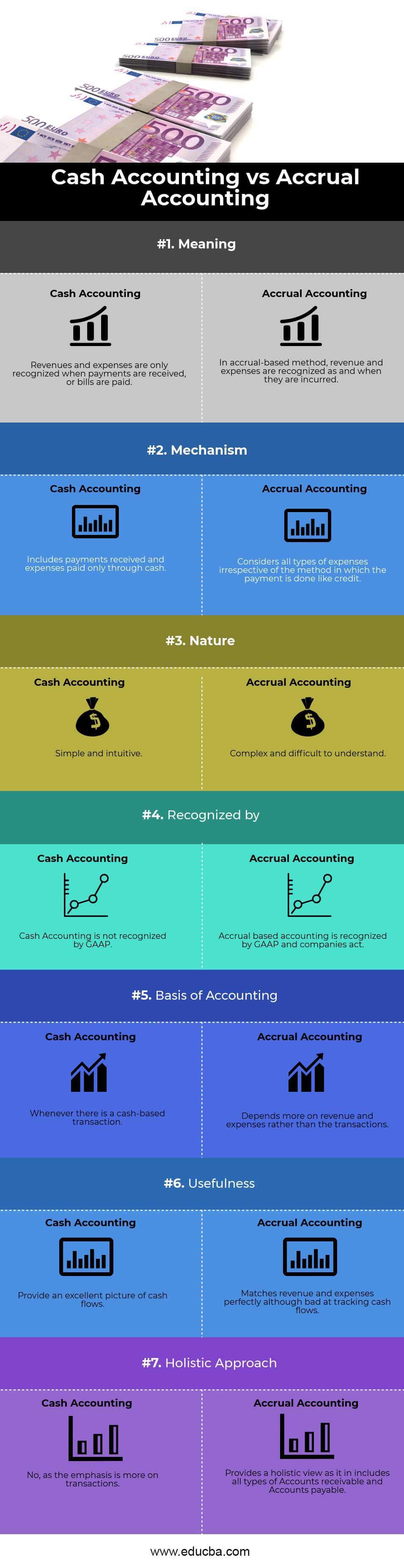

Cash accounting recognizes expenses and revenue when the funds change hands while accrual accounting recognizes them when they are incurred. Accrual accounting is the method of recording revenue and expenses when they are earned regardless of whether the money has yet been received or the invoice has been.

|

| Accrual Vs Cash Accounting Which To Choose Acclime Singapore |

A practice that uses elements of accrual accounting with cash basis.

. Accrual accounting follows a double-entry system. Accrual Basis and Cash Basis accounting are both useful in their own ways. Here a business records revenue when cash is received and expenses when cash is paid. The cash method of.

The difference between accrual basis and cash accounting is the timing of when you record sales and purchases in your accounts. With accrual accounting you recognize revenue when it is. The Accrual Method In contrast to the cash method accrual basis accounting entails recording revenue once an invoice is made and recording expenses once youre. Cash Basis vs Accrual Basis of Accounting.

Accrual accounting means that a companys. For example in the situation where a. Accrual accounting provides a clearer overall picture of the businesss financial situation than cash accounting might. Pros and cons of accrual accounting.

However the accrual method accounts for earnings the moment they are. In contrast accrual accounting recognizes revenue when its. Accrual is used for line items like inventory depreciation and amortization. While it does provide a better long-term view of your companys finances accrual accounting provides an abysmal short-term financial.

Under the cash basis the seller recognizes the sale in April when the cash is received. Cash basis accounting recognizes revenue when a payment is physically received in the business bank account. The IRS Publication 538 012022 Accounting Periods and. Under the accrual basis the seller recognizes the sale in March when it issues the.

Double-entry Systems Cash accounting follows a single entry system. In cash accounting the exchange of cash decides when revenue and expenses are recognized. While the majority of items. However the accrual basis of accounting is the most used.

Cash accounting means that a companys income or expenses are recorded when it is paid or makes a payment. Cash and accrual accounting methods are among the most common methods of accounting according to the IRS. Inaccurate Short-Term Financial Overview. Cash accounting on the other hand can be less reliable due to its reliance on actual cash inflows and outflows which can fluctuate significantly from month to month.

Cash-basis accounting documents earnings when you receive them and expenses when you pay them. Accuracy Cash accounting isnt very accurate as the focus is.

|

| Cash Accounting Vs Accrual Accounting Top 9 Differences |

|

| Cash Vs Accrual Accounting Which Is Best For Your Business |

|

| Accrual Accounting Vs Cash Basis Accounting What Is The Difference |

|

| Cash Vs Accrual Accounting In Financial Projections Plan Projections |

|

| Cash Vs Accrual Accounting For Your E Commerce Business Mehanna Cpas Advisors 199a Deduction |

Posting Komentar untuk "accrual vs cash"