average debt by age

2015-2019 change in debt. 6 rows As you can see consumers age 62 and older have the lightest debt burden followed by those.

Personal Loans Online Personal Loans Online Credit Cards Debt Credit Card Debt Settlement

35-year-olds have the very best common excellent student loan debt at 42600 per borrower with an finish steadiness 287 larger than the worth of their authentic loan.

. Seniors in this age group had some advantages over other age groups. Baby boomers hold. 28317 Gen X. On the other hand the greatest number of borrowers are ages 25 to 34 149 million total borrowers and the greatest amount of debt is held by those ages 35 to 49 613 billion total debt.

Average Debt By Age. The top 10 of Americans with the highest net worth are the biggest debtors. On average consumers credit card debt tends to look like the top half of a balloon rising steadily during their early 20s to their early 50s and then falling steadily from their early 50s until the end of their lives according to an Experian reportThe report examined card debt by age group in the second quarter of 2019. Average Debt By Age.

The average debt load for someone in their 20s 30s 40s 50s. Baby Boomers and those from the Silent Generation noted average debt increases of minor 2 and 1. Studying average American debt by age tells us that those under 35 and over 65 tend to have the lowest amounts of debt often because theyve not accumulated much debt or have paid it off already respectively. 12524 Gen Y.

Average Personal Loan Debt Increases by Age The average personal loan debt for borrowers ages 43 to 81 was consistently above the national average of 16529 according to Experian data. The average credit card debt for borrowers 40 to 69 was consistently above the national average of 6194 according to Experian data. Average credit card balance. Who has the most debt out of all of us.

Credit Card Debt Millennials and individuals over 74 years old have the least amount of credit card debt 5808 and 5638 respectively but these groups are also among the least likely to have a credit card. Current Age 57 to 75 Total credit card debt. 24136 Silent Generation. Average auto loan balance.

There was an increase of 6 from 224500 to 237349 among MillennialsGen Y. It indicates the speed at which the debtors are converted into cash. Consumers in Their 20s. Consumers Ages 40 to 69 Have Above Average Credit Card Debt.

Among those in this age group who have debt secured by their primary residence average mortgage debt is 130700. How Do You Compare Against Normal AmericansTake Your Finances to the Next Level Subscribe now. Median debt levels excluding mortgages peak for households where the reference person is between 18 and 34 years oldthis age group has an average non-mortgage household debt level of 10400 and a median debt level of 4800 in other words half of the indebted households in the 18 to 34 age bracket have at least 4800 of debt. The same is calculated as.

The highest amount of credit card debt belongs to the age group between 45 and 54 years old 9096. Median value of 40000 for this age group compared for example with 22700 among those in their early 70s. Average non-mortgage debt by generation Gen Z. Among those who carry debt the average debt level is just 57500.

Indeed personal loan balances tend to increase with age until age 82 when they begin to declinethe same year balances start to dip below the national average. Credit allowed by the Company X to its customers is one month. Debt peaks between ages 40 and 49 and the average amount varies widely across the country. This may suggest a greater propensity for households to downsize around this age while crucially maintaining all or part of their existing mortgage and instead releasing the equity from their previous.

On average their retail credit card debt is 2100 according to Experians 2020 State of. Average personal loan. Average debt 2019. The average credit card balance among consumers in their 20s was 2709 in Q2 2019.

The Average Debt for Those 75 Seniors age 75 and older have by far the lowest average debt. Student loan debt varies significantly by age with those ages 50 to 61 holding the highest average debt at 43444. What the biggest debt load category is for someone in their 20s. This generation carries an average of 7550 in total credit card debt per person the.

Average age of debtors is also known as Debtors Turnover Ratio. The statistics of Americans who are dealing with debt. Retail credit card debt. Student debtors aged 30 to 44 years owe 8232 billion or 49 of.

Let us make an in-depth study of the formulas and calculations of average age of debtors. The percentage of accounts that were 30 or more days past due decreased by 27. Adults have this type of debt and personal loan average American debt stands at 16458. How much you should invest in your 20s.

The average American has 52940 worth of debt across mortgage loans home equity lines of credit auto. Gen Z Americans noted the highest increase in average mortgage balance by age from 142600 to 169470 or 19. Nearly a quarter of US.

The Median Debt Of Americans By Age Education And Other Demographics Titlemax Debt Demographics Education

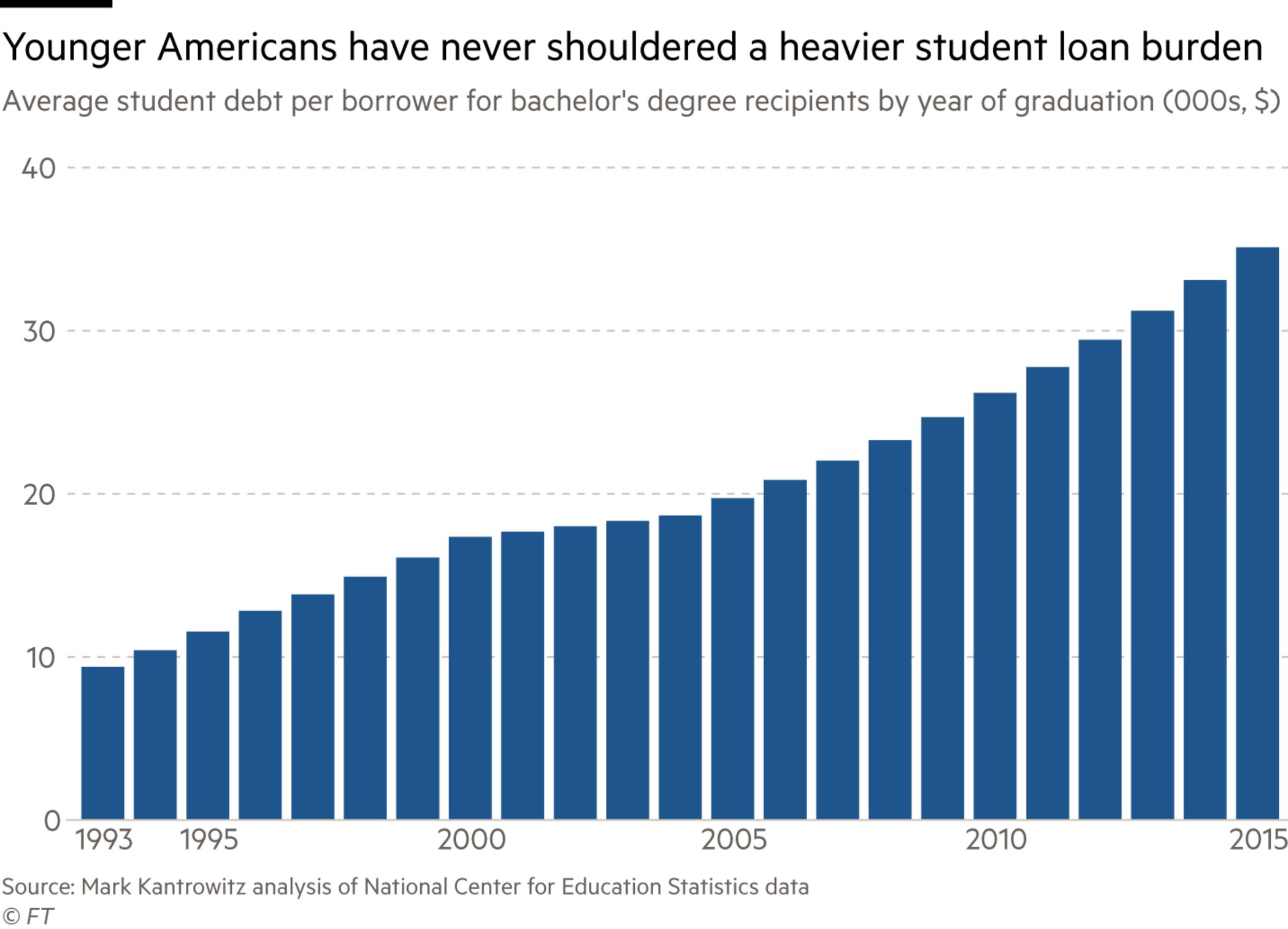

Five Charts Show Why Millennials Are Worse Off Than Their Parents Student Debt Coming Of Age The Borrowers

Here S How Much Debt Americans Have At Every Age Budgeting Finances Financial Peace University Dave Ramsey Baby Steps

Economics Credit Cards Debt Credit Card Debt

This Chart Shows Average Annual Household Spending By Age Group Spending Ranges From 57 725 Per Average Retirement Income Retirement Budget Financial Health

Posting Komentar untuk "average debt by age"